Assemble the Whole Team!TAIWAN EDTECH

Over the past 600 days, the pandemic has changed the world, and the world has changed us. At the same time, it has also inspired many innovative industrial models, resulting in unprecedented qualitative and quantitative transformation. If the boundary between physical and virtual becomes more blurred, then how can we sustain the new normalcy for post-epidemic? How should the industry face the global open market? Let us consider the crisis as fuel because it is accelerating the growth of educational technology!

The "METEAEDU" program promoted by the Industrial Development Bureau of Taiwan's Ministry of Economic Affairs is going to lead the education technology industry into the global arena and move towards common prosperity. The report is broken down into the following sections:

Industry overview, Market value, Overseas expansion and Future trends.

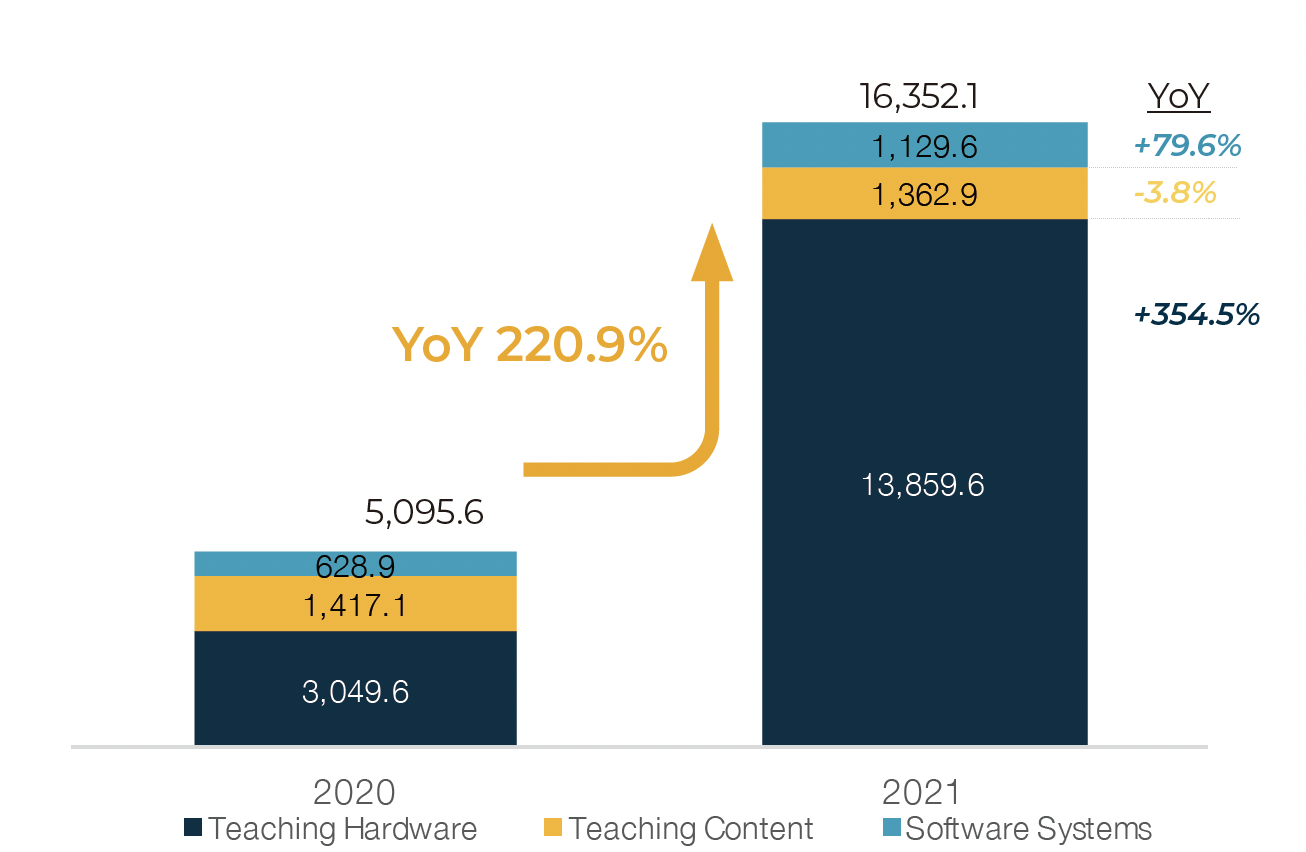

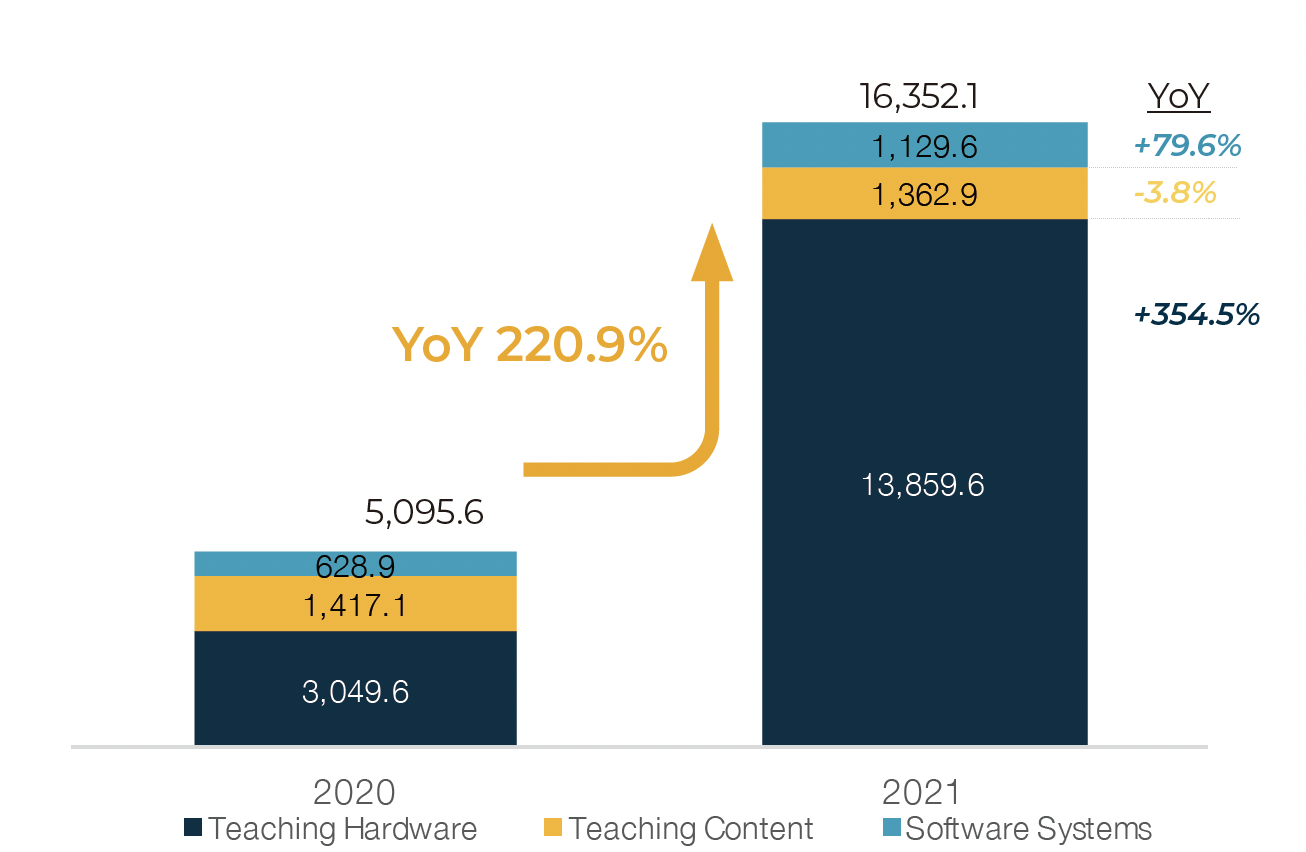

The report also listed HolonIQ 2021 Taiwan EdTech 50, the most innovative EdTech companies selected by HolonIQ, the world's largest scientific and education technology research institute. In 2021, the Taiwan EdTech Industry total output value has reached 16.4 billion U.S. dollars. 220.9 % growth compared with 2020, which highlights Taiwan's key role in the global information and communications supply chain under the epidemic.

The "METEAEDU" program promoted by the Industrial Development Bureau of Taiwan's Ministry of Economic Affairs is going to lead the education technology industry into the global arena and move towards common prosperity. The report is broken down into the following sections:

Industry overview, Market value, Overseas expansion and Future trends.

The report also listed HolonIQ 2021 Taiwan EdTech 50, the most innovative EdTech companies selected by HolonIQ, the world's largest scientific and education technology research institute. In 2021, the Taiwan EdTech Industry total output value has reached 16.4 billion U.S. dollars. 220.9 % growth compared with 2020, which highlights Taiwan's key role in the global information and communications supply chain under the epidemic.

2021 Overall Market ValueUS$16.4 billion

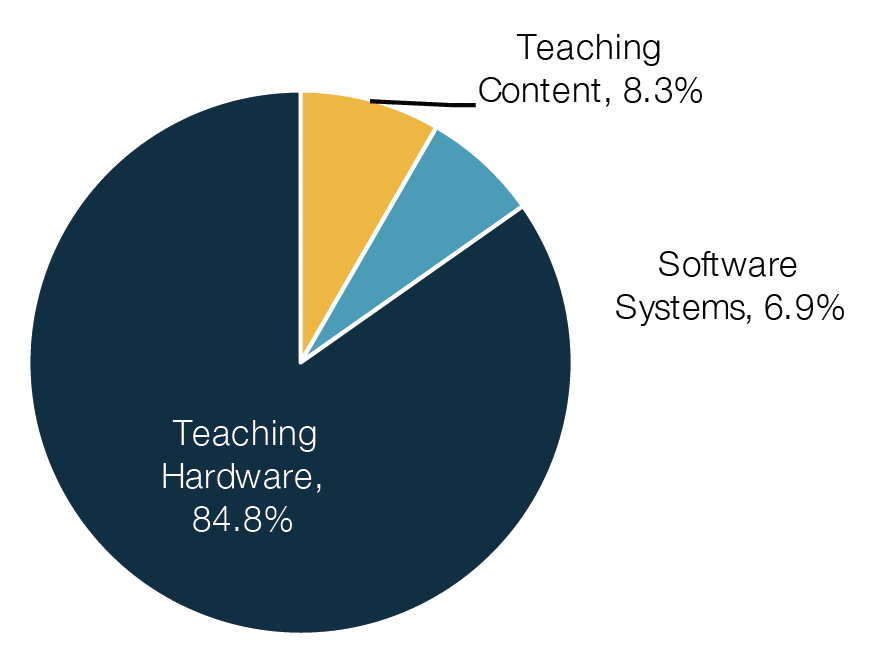

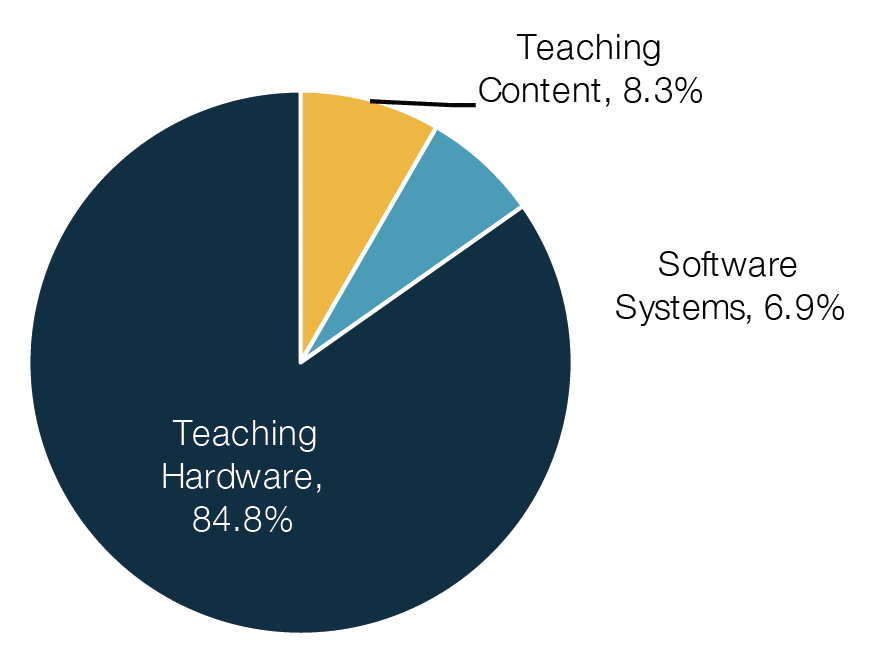

The scope of research for Taiwan’s EdTech industry are divided into 3 categories: teaching content, software systems, and teaching hardware. The survey results indicated that Taiwan’s total market value of EdTech in 2021 is US$16.4 billion.

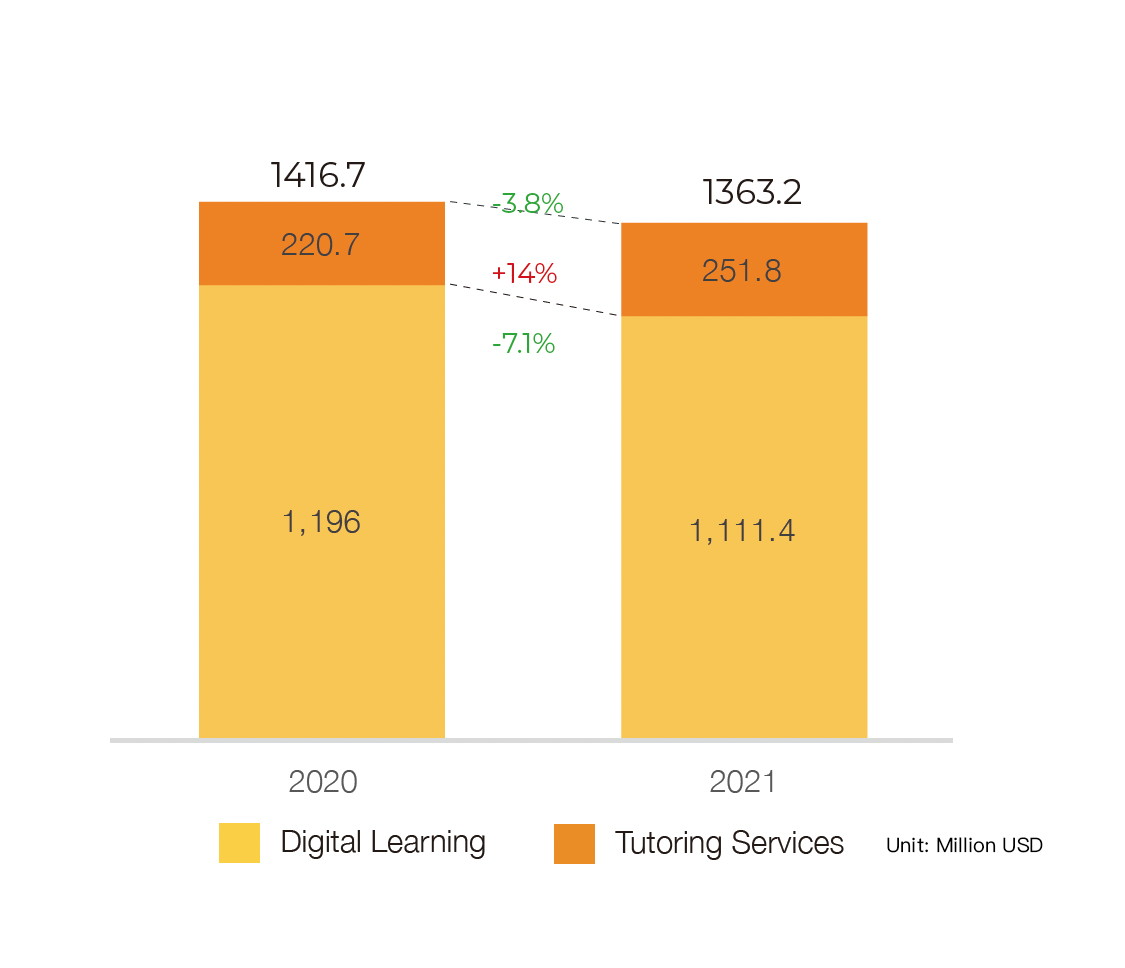

Among them, the market value of teaching hardware is US$13.9 billion, which accounts for more than 80% (84.8%) and is 25% higher than that of the survey result in 2020. Secondly, the market value of teaching content is US$1,36 billion, which accounts for 8.3%. The market value of software systems is US$1.13 billion, which accounted for 6.9% (as shown in the figure below).

Among them, the market value of teaching hardware is US$13.9 billion, which accounts for more than 80% (84.8%) and is 25% higher than that of the survey result in 2020. Secondly, the market value of teaching content is US$1,36 billion, which accounts for 8.3%. The market value of software systems is US$1.13 billion, which accounted for 6.9% (as shown in the figure below).

2021 YoY 220.9%

Compared to the survey results in 2020, the annual growth rate of the overall market value is as high as 220.9%. An assessment of the changes in the composition of the market value for the past 2 years indicated that the main growth momentum for the market value in 2021 comes from the explosive growth in demand for teaching hardware. Since the market value survey in 2021 reflects the operating performance in 2020, a review of the dynamics in 2020 indicated that under the global COVID-19 crisis, the demand for personal education communication equipment (notebooks, tablets, desktop computers, monitors, etc.) has increased dramatically since the first quarter of 2020.

Starting from the second quarter of 2020, the shipment volume of related products has increased significantly compared to the same period in 2019. This demand boom has become increasingly intense as the COVID-19 status gradually enters its peak period, and maintained a strong growth momentum throughout 2020. Not only has it driven Taiwan’s EdTech market value, but it has also highlighted the indispensable and key role that our nation’s industry plays in the global information and communications supply chain.

Starting from the second quarter of 2020, the shipment volume of related products has increased significantly compared to the same period in 2019. This demand boom has become increasingly intense as the COVID-19 status gradually enters its peak period, and maintained a strong growth momentum throughout 2020. Not only has it driven Taiwan’s EdTech market value, but it has also highlighted the indispensable and key role that our nation’s industry plays in the global information and communications supply chain.

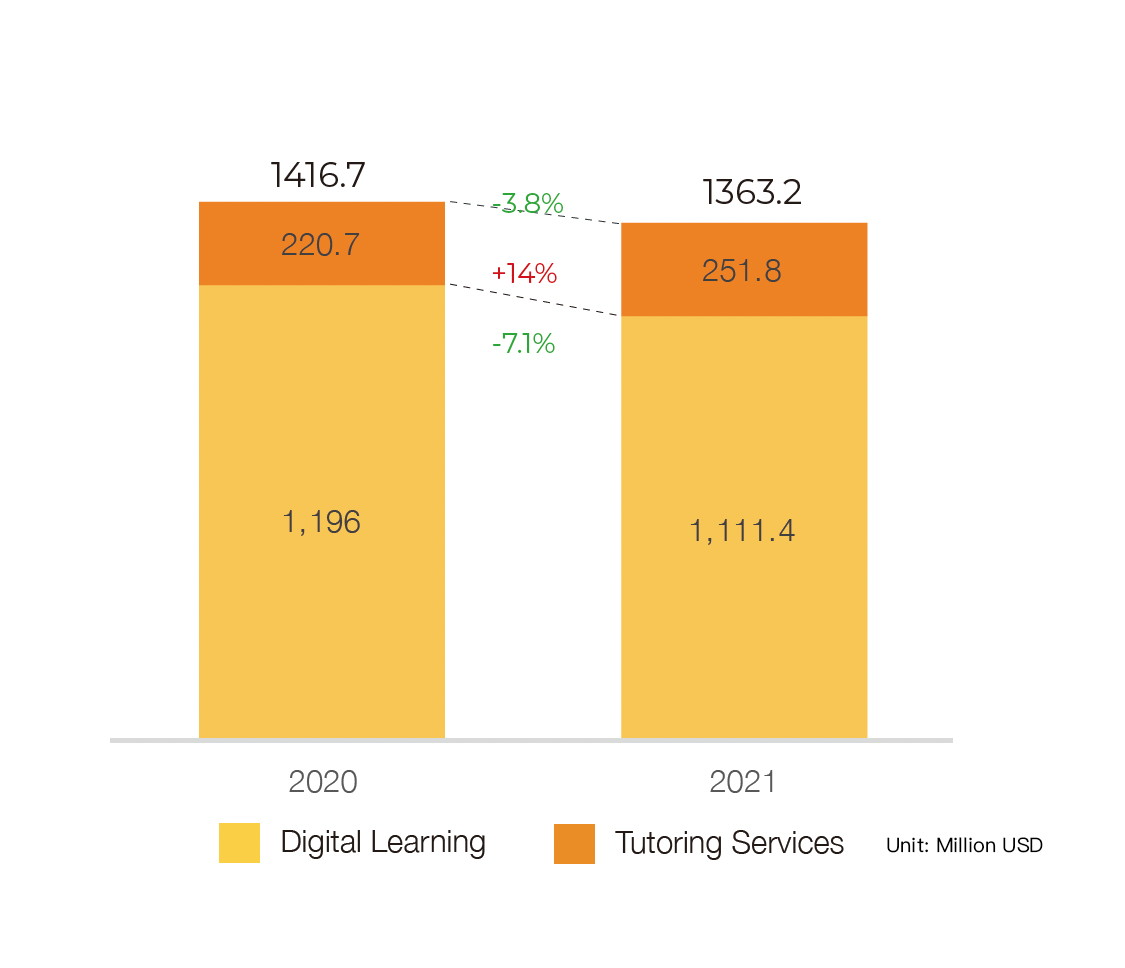

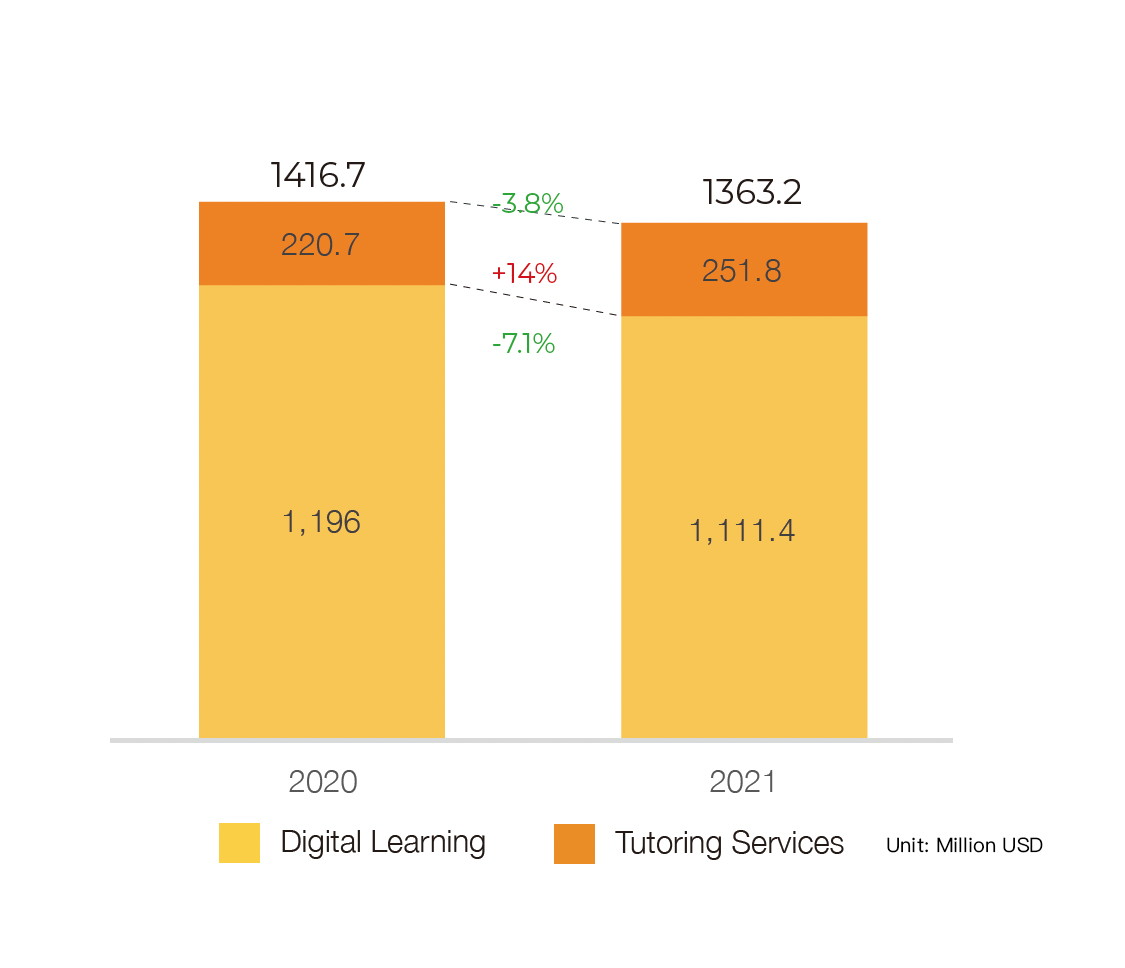

Teaching Content

Tutoring Services Rapid Growth

market value of the “Digital Learning” sub-industry. The reason is speculated that it was because the epidemic status in 2020 was properly controlled, and an urgent “online to offline” situation has not yet been created. Moreover, the impacts of COVID-19 on economic life tend to make people more conservative of non-rigid demand consumption decisions, which was unfavorable to the “Digital Learning” development.

Take listed cultural and educational company as an example. Except for a few that can grow against the trend, the operating performance of most businesses in 2020 has been affected by the overall environment and showed a negative growth trend.

In contrast, “Tutoring Services” grew by 14% in 2020. In addition to the relatively small base period, it also indicated that such services are considered emerging services and demands in the industry, which are in a stage of rapid growth.

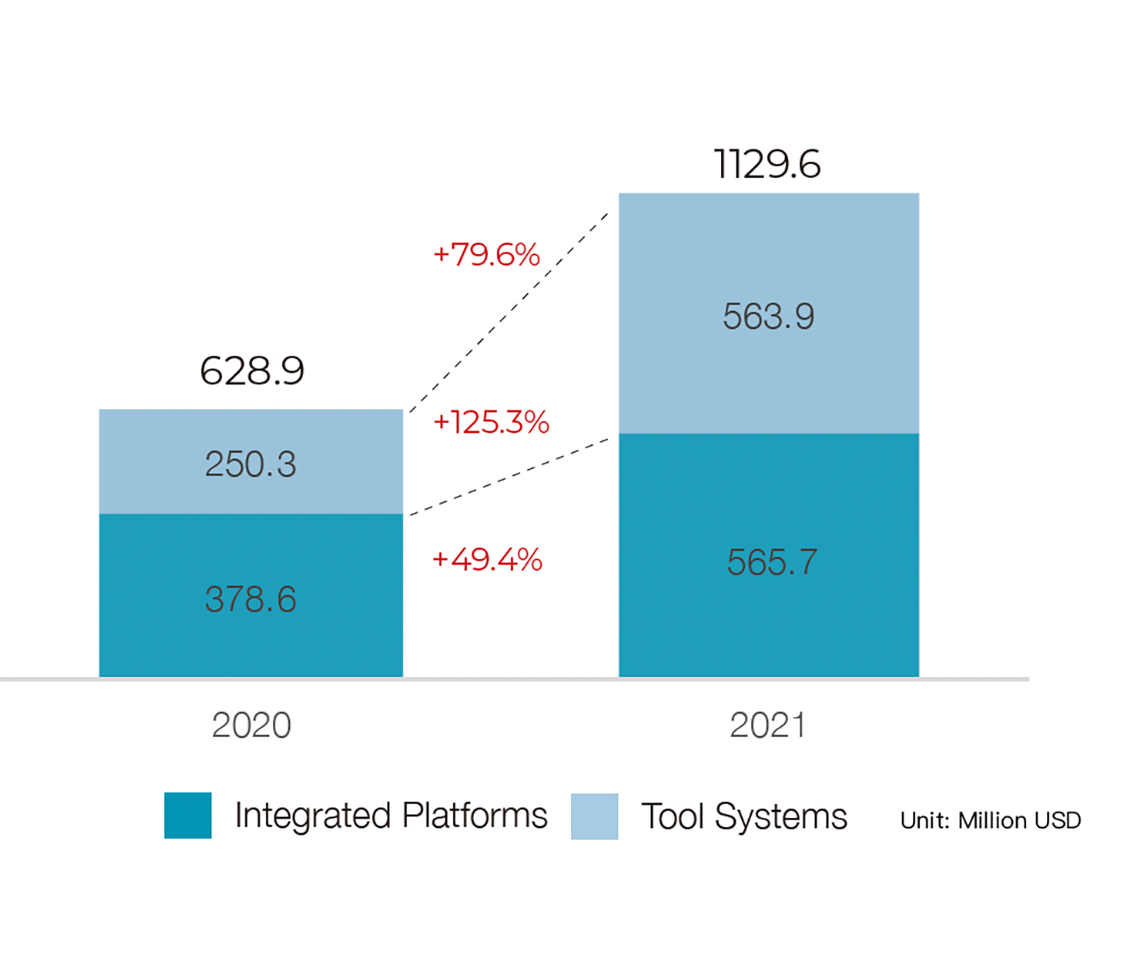

Software System

Unprecedented Growth

The market value of software systems is US$1,129.6 million, which grew by 79.6% compared to 2020. Among them, the market value of the “Integrated Platforms” sub-industry is US$565.7 million, which accounted for 50.1% of software systems. The market value of the “Tool Systems” sub-industry is US$563.9 million, which accounted for about 49.9% of software systems.

In 2021, the market value of software systems has experienced unprecedented growth momentum and development opportunities. Both “Integrated Platforms” and “Tool Systems” have experienced significant growth. These industry sectors have benefited more from the COVID-19 epidemic. Among them, “Integrated Platforms” cover direct consumer learning platforms (B2C) and institution-oriented platform services (B2B). Since the outbreak of COVID-19 in early 2020, traffic flows for both 2C and 2B platforms have increased for the first time. However, due to differences in revenue models, 2C platforms can convert traffic to revenue faster than that of 2B platforms. Therefore, learning platforms have also become the subject of media coverage during the COVID-19 epidemic and attracted attention from all walks of life.

Teaching Hardware

Pandemic leads Abnormal Results

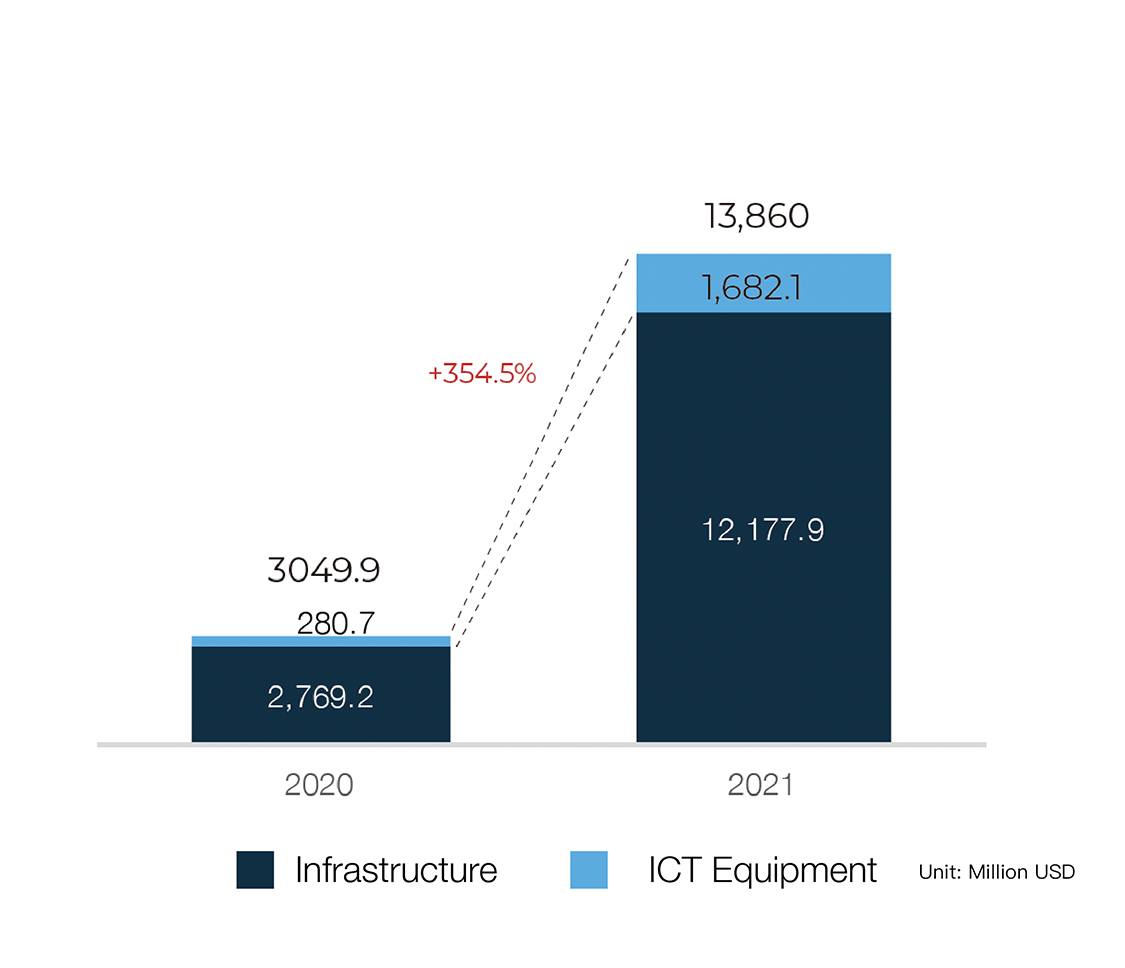

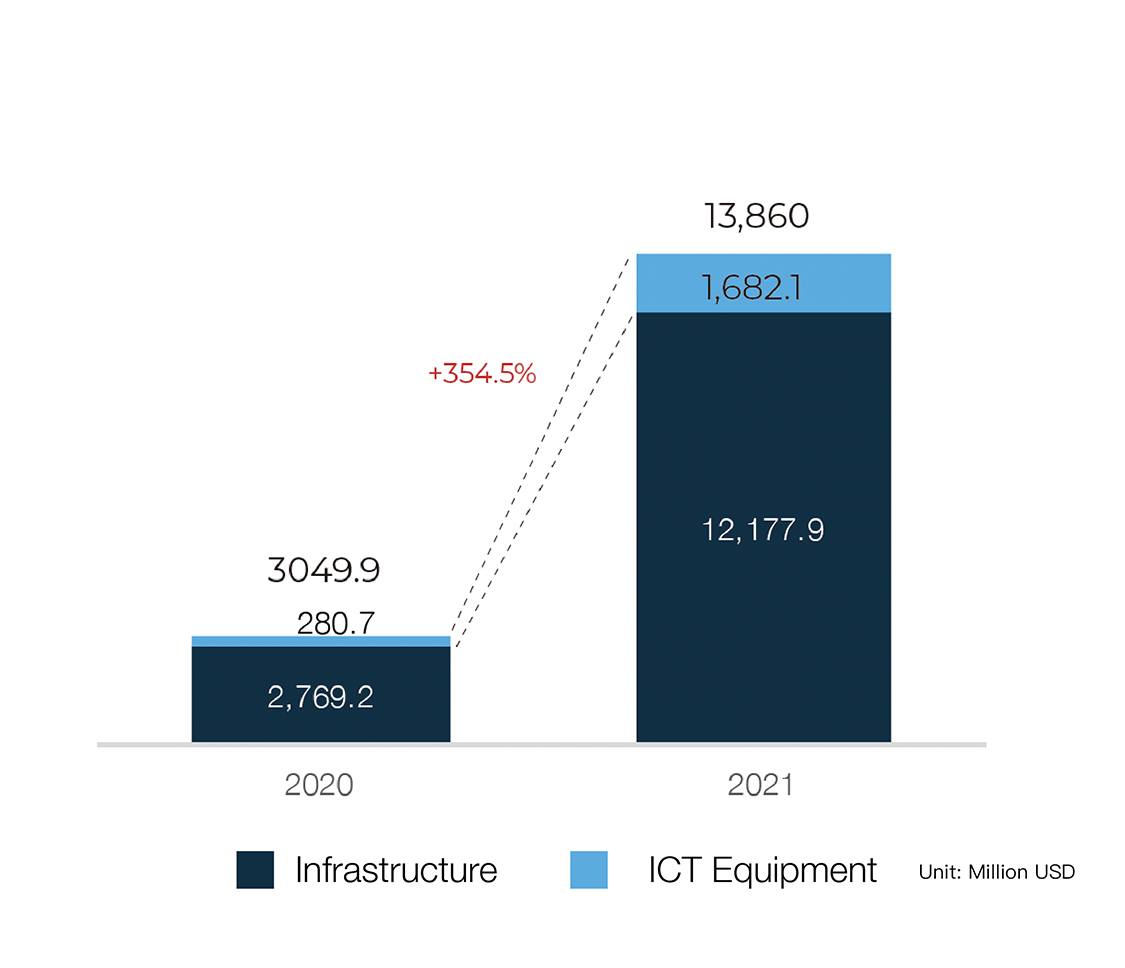

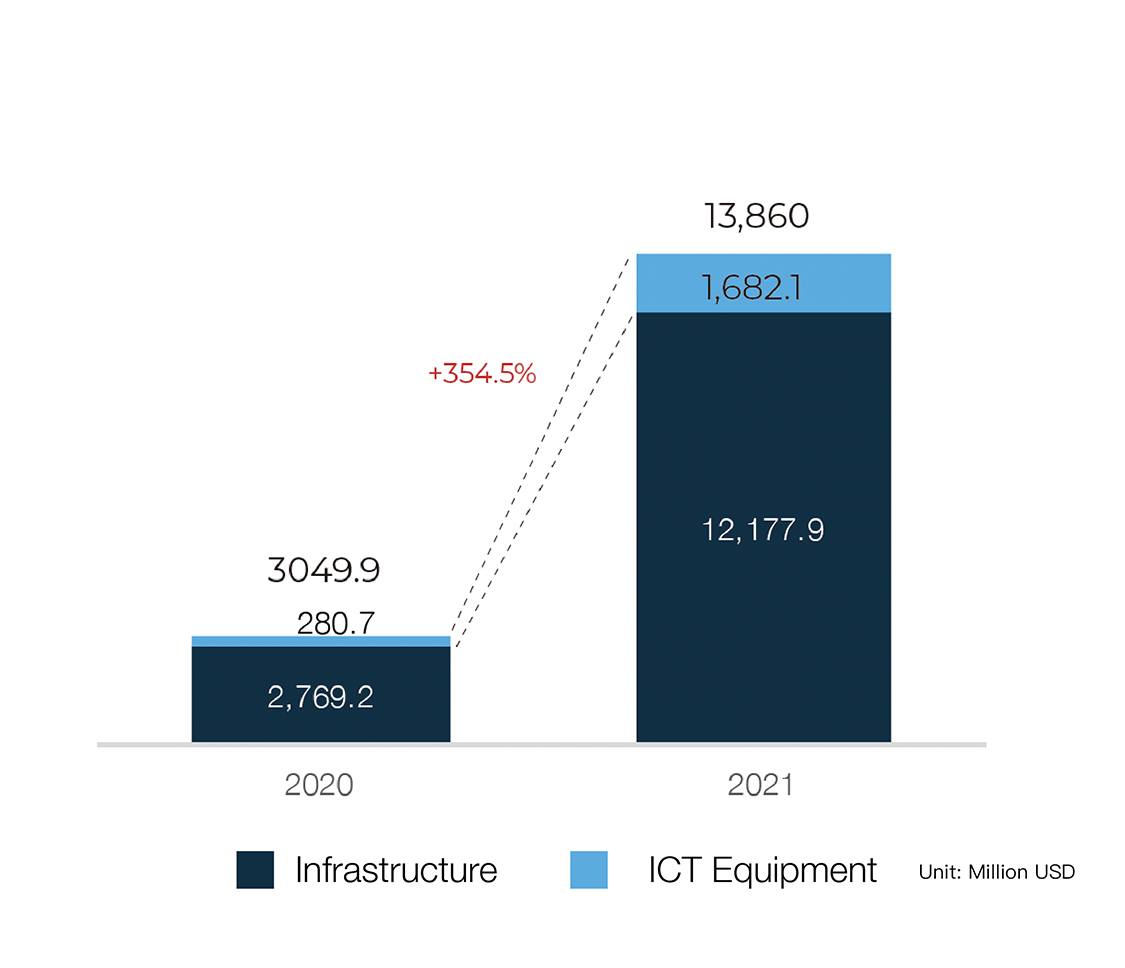

The market value of teaching hardware is US$13,860 million, which increased by 354.5% compared to the 2020 survey results. The market value of the “Information Equipment” sub-industry is US$12,177.9 million, which accounted for 87.9% of teaching hardware. The market value of the “Infrastructure” sub-industry was US$1,682.1 million, which accounted for 12.1% of teaching hardware.

The EdTech market value survey results in the past years indicated that teaching hardware has always maintained the highest ratio of the 3 categories. But the COVID-19 crisis in 2020 has shifted personal, industrial, and social operation patterns. The demands for personal teaching, learning resources, communication products, and network-related facilities have intensified this situation. This resulted in a rapid increase in the market value of teaching hardware, and the overall market value has shown “abnormal” results.

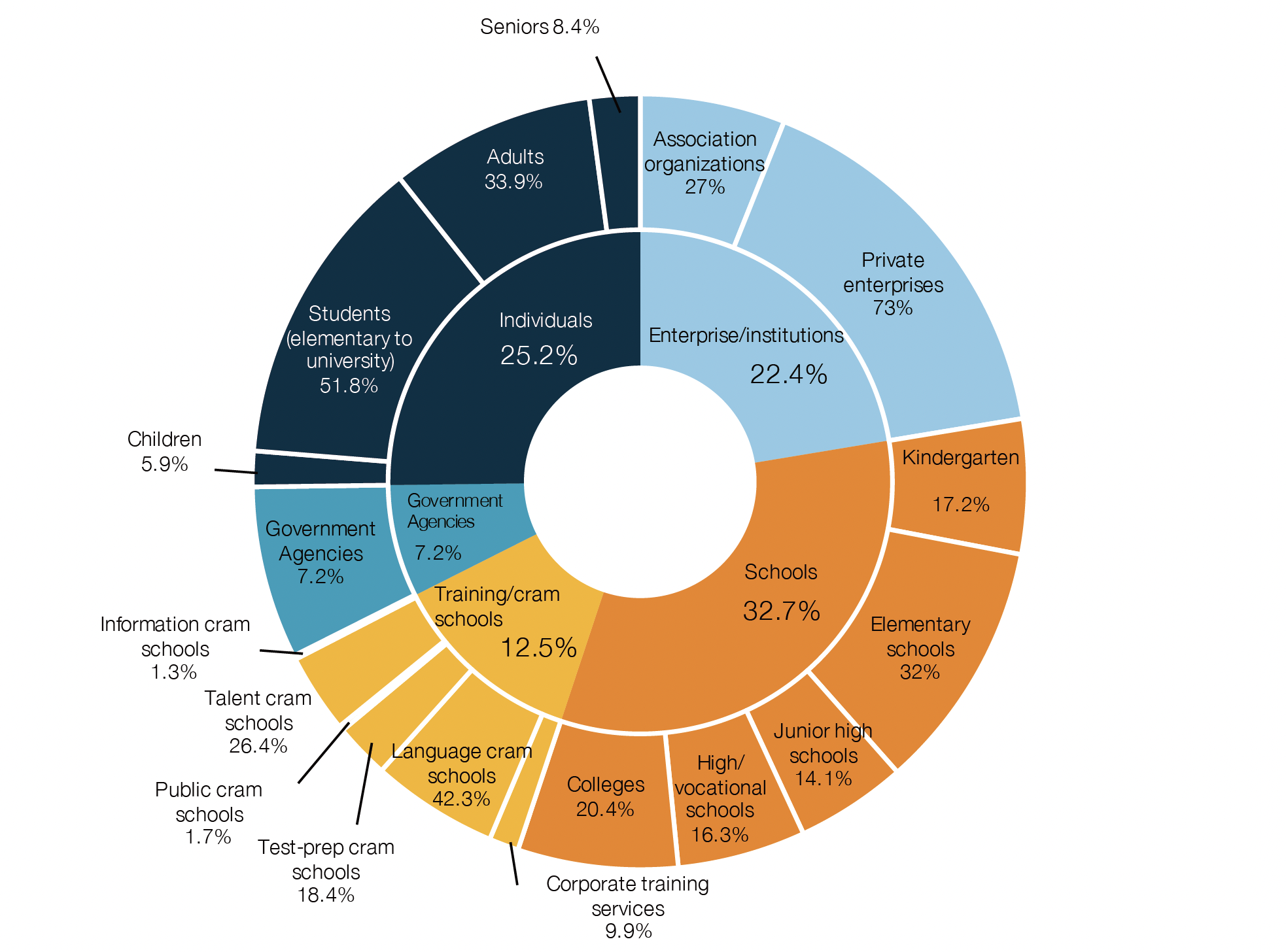

2021 Customer Analysis

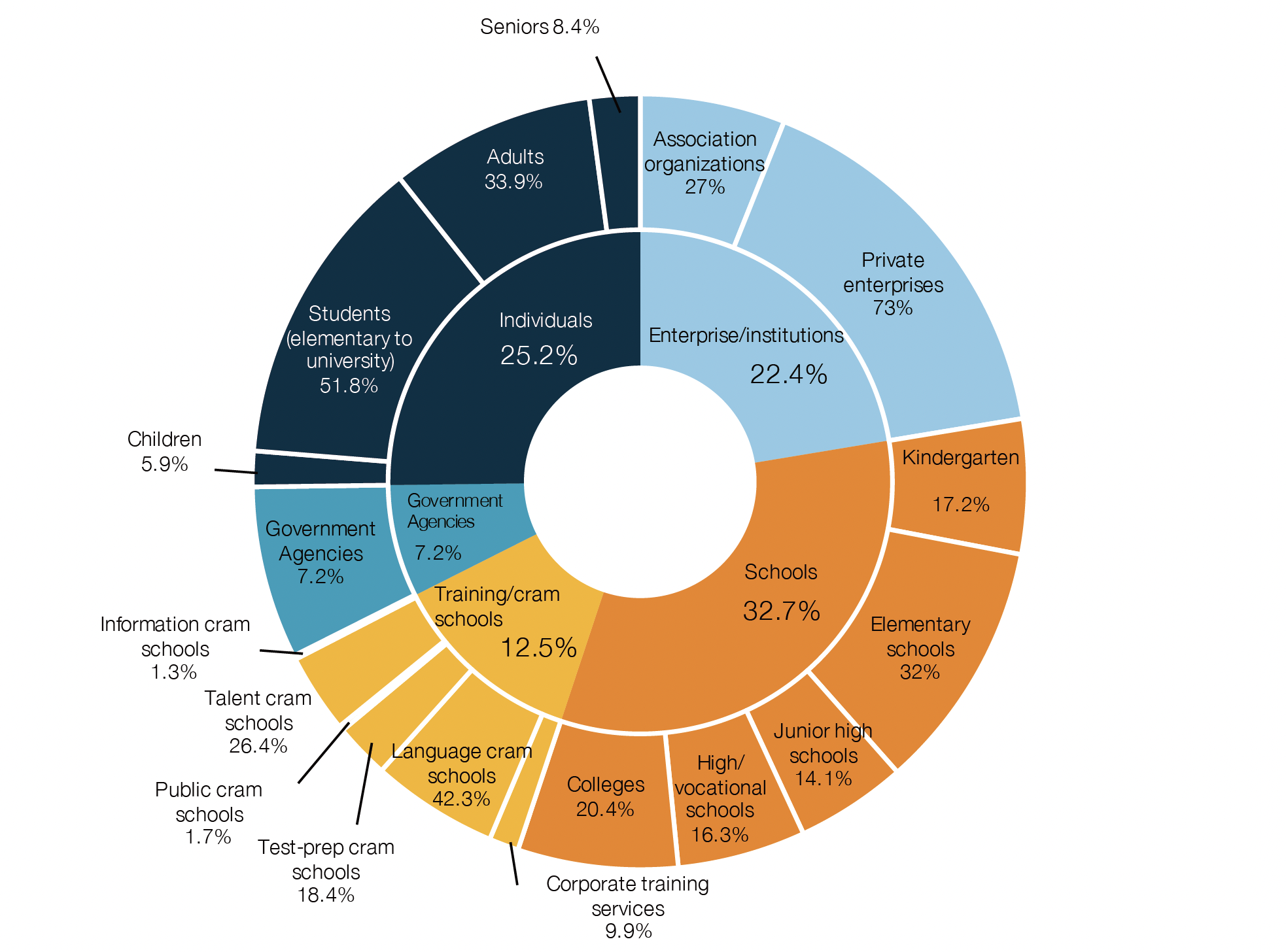

According to the 2021 survey results, the types and ratios of our nation’s EdTech industry customers are ranked as follows: “Schools” (32.7%), “Individuals” (25.2%), “Enterprises/Institutions” (22.4%), “Training/cram schools” (12.5%), and “Government Agencies” (7.2%). Apparently, “Schools” are still the most important source of customers for EdTech companies in our nation, which account for over 30%. It is noteworthy that in the past survey results, higher education institutions such as “Universities and Colleges” accounted for the highest ratio of school segment sub-customers. The 2021 survey results indicated that “Elementary Schools” (32%) accounted for a relatively high ratio for basic education. This indicated that under the special COVID-19 circumstances, the government has readjusted the budget resource allocation to protect the people’s rights to receive basic education.

Another worthwhile issue is the “Training Outsourcing” business opportunities for corporate/institutional customers. According to the 2019-2020 survey results, corporate customers accounted for about 13%, which is a relatively low percentage among the top 5 customers. This indicated that the use of EdTech products and services by enterprises in the past is not high. However, under the dual stimulus of COVID-19 and the wave of digital transformation for the industry, companies have become more proactive in their willingness to invest in “non-contact” learning styles. The investment willingness by company “Talent Transformation” service providers has intensified, and the ratio has increased to 22.4% according to the 2021 survey results. The digital transformation of various industries is still in full swing in 2021. Companies urgently need to find digital transformation solutions for all levels of operations. Therefore, it is predicted that there will be more EdTech industry developments in terms of “training outsourcing” for enterprises, which is worthy of continual observation and attention.

Another worthwhile issue is the “Training Outsourcing” business opportunities for corporate/institutional customers. According to the 2019-2020 survey results, corporate customers accounted for about 13%, which is a relatively low percentage among the top 5 customers. This indicated that the use of EdTech products and services by enterprises in the past is not high. However, under the dual stimulus of COVID-19 and the wave of digital transformation for the industry, companies have become more proactive in their willingness to invest in “non-contact” learning styles. The investment willingness by company “Talent Transformation” service providers has intensified, and the ratio has increased to 22.4% according to the 2021 survey results. The digital transformation of various industries is still in full swing in 2021. Companies urgently need to find digital transformation solutions for all levels of operations. Therefore, it is predicted that there will be more EdTech industry developments in terms of “training outsourcing” for enterprises, which is worthy of continual observation and attention.

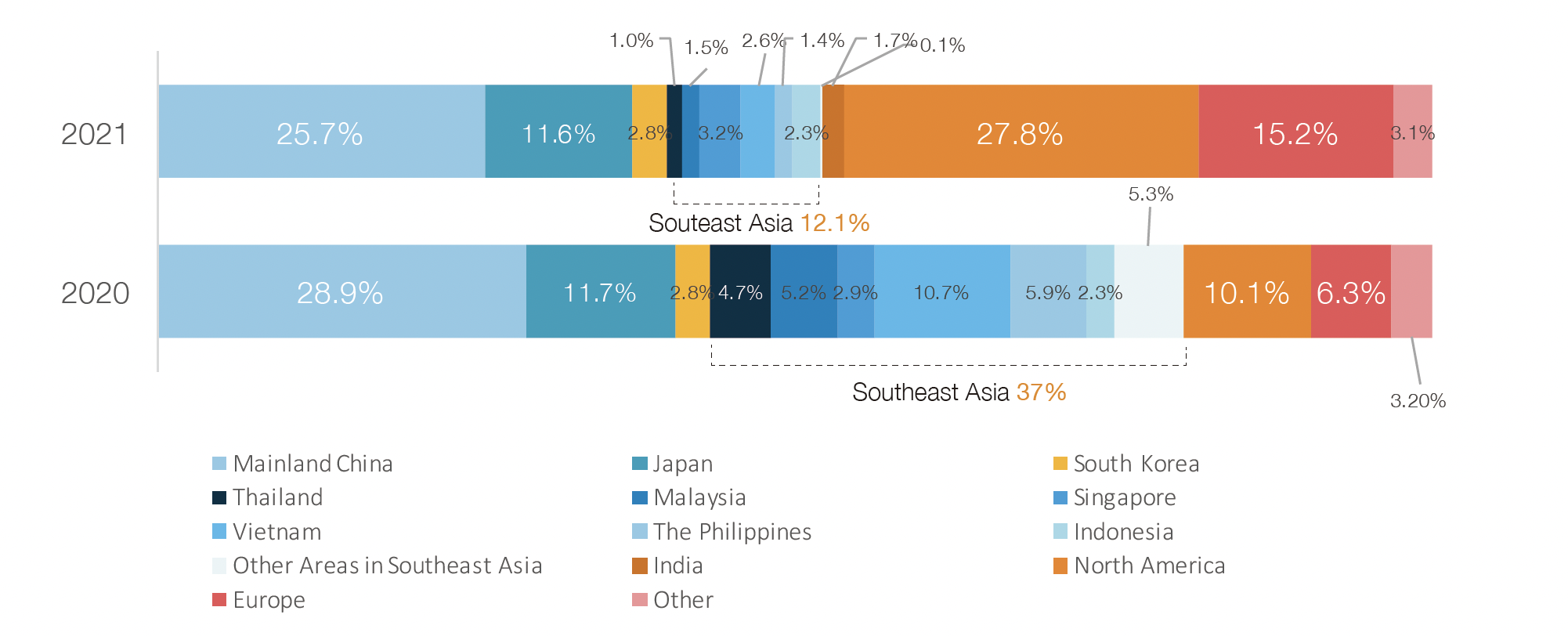

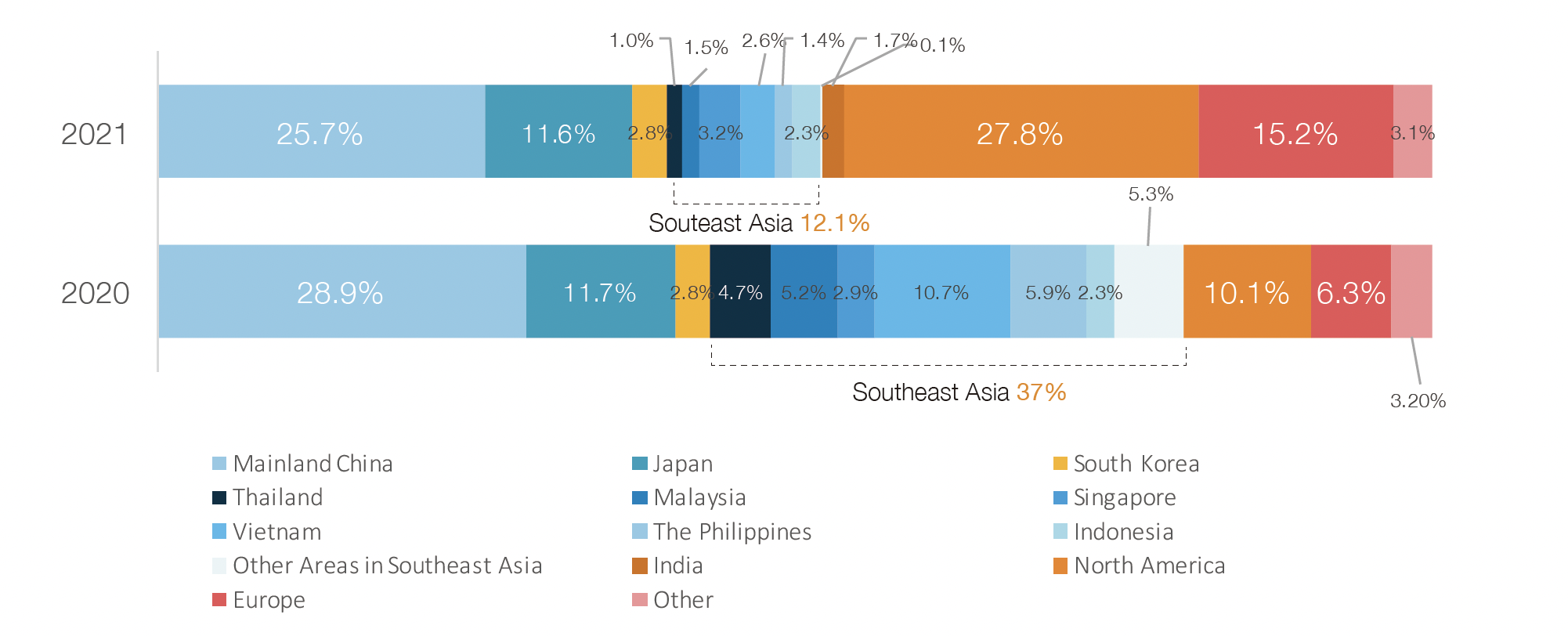

2021 Overseas Market ValueUS$12.18 billion

2021 the total overseas market value for Taiwan’s EdTech industry is US$12,183.2 million(12.18 billion). Compared to the survey results of 2020, the annual overseas market value growth rate has reached 410.2%. This shows that the market value found by the 2021 survey has reached a historical high, was mainly driven by strong and urgent demands in overseas markets, and the bulk of overseas demand comes from the shipment and sales of our nation’s teaching-related information and communication hardware products. the top 4 markets for our nation’s EdTech industry overseas sales are as follows:

North America (27.8%), Mainland China (25.7%), Europe (15.2%), Japan (11.6%). The sales of other overseas regions accounted for less than 6%.

North America (27.8%), Mainland China (25.7%), Europe (15.2%), Japan (11.6%). The sales of other overseas regions accounted for less than 6%.

2021 TAIWAN EdTech 50

2021 TAIWAN EdTech 50

HolonIQ’s annual list of the most innovative EdTech companies across Taiwan.